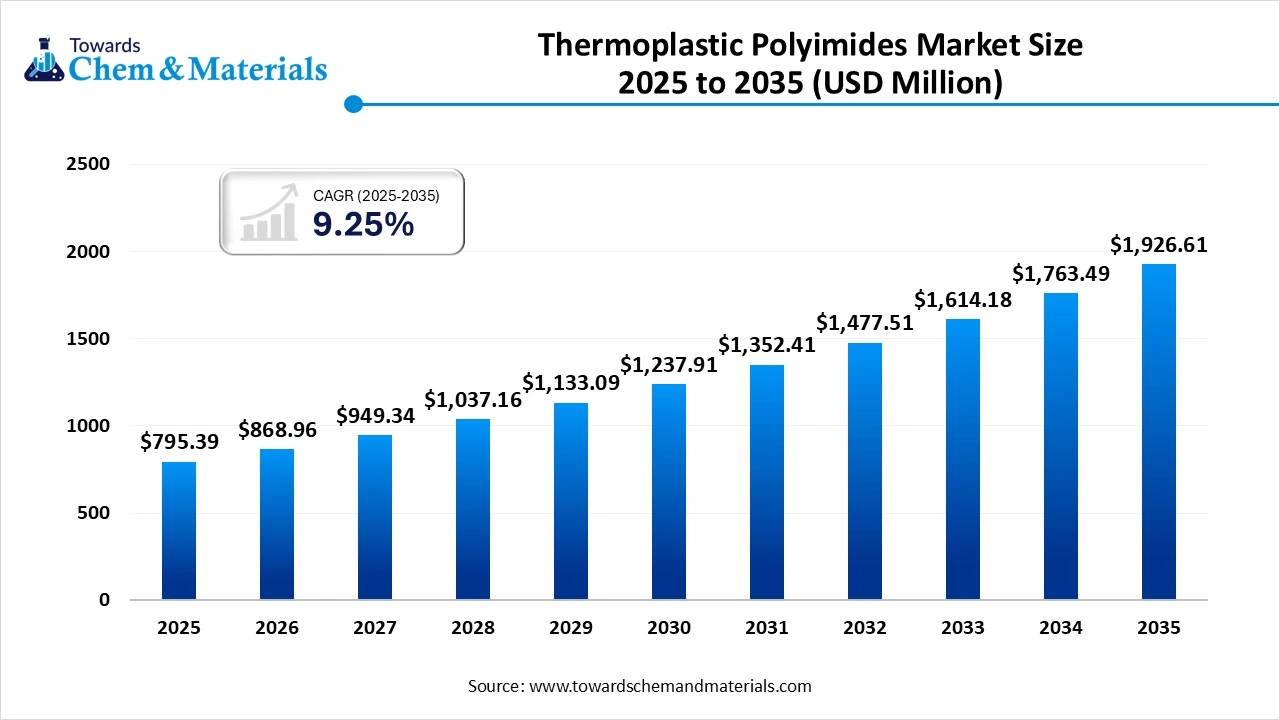

Ottawa, Dec. 29, 2025 (GLOBE NEWSWIRE) -- The global thermoplastic polyimides market size was estimated at USD 795.39 million in 2025 and is expected to increase from USD 868.96 million in 2026 to USD 1,926.61 million by 2035, growing at a CAGR of 9.25% from 2026 to 2035. North America dominated the Thermoplastic Polyimides market with the largest revenue share of 35.48% in 2025. Increasing demand for high-performance materials in the aerospace and automotive sectors due to their lightweight and heat-resistant properties drives the growth of the thermoplastic polyimides market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6067

What are Thermoplastic Polyimides?

The global thermoplastic polyimides market represents a specialized segment of high-performance polymers characterised by exceptional thermal stability, chemical resistance, mechanical strength, and electrical insulation properties, making these materials essential in demanding aerospace, automotive, electronics, electrical, and industrial applications where durable, heat-resistant, and lightweight materials are required.

The market’s expansion is driven by rising demand across advanced industries such as flexible electronics, next generation semiconductor packaging, electric vehicle components, and lightweight aircraft parts, while ongoing innovation in processing technologies and sustainable material development continues to broaden application opportunities and enhance material performance.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Thermoplastic Polyimides Market Report Highlights

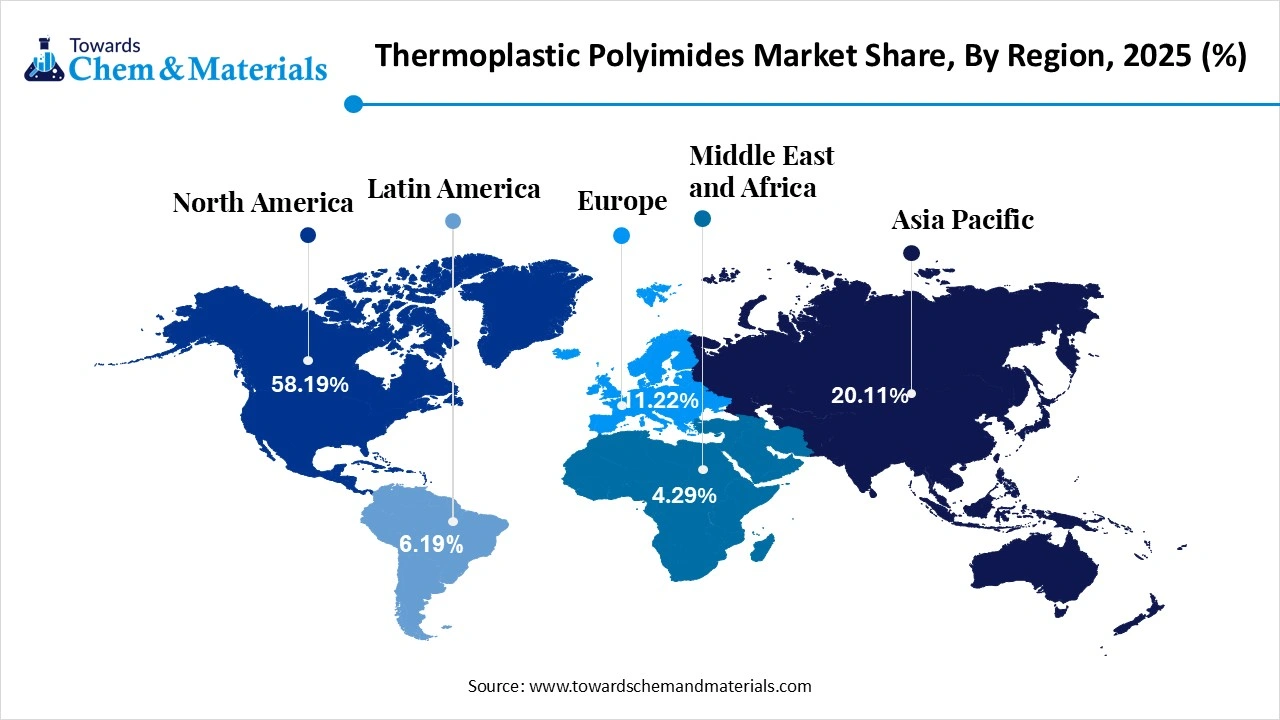

- By region, North America led the thermoplastic polyimides market with the largest revenue share of over 35.48% in 2025.

- By product type, the film/sheets segment led the market with the largest revenue share of 41% in 2025.

- By application, the electronics & electrical segment led the market with the largest revenue share of 36.12% in 2025.

- By technology/ processing type, the injection molding segment accounted for the largest revenue share of 31.11% in 2025.

- By distribution channel, the direct sales segment dominated with the largest revenue share of 51.48% in 2025.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6067

Thermoplastic Polyimides Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 868.96 Million |

| Revenue forecast in 2035 | USD 1,926.61 Million |

| Growth rate | CAGR of 9.25% from 2026 to 2035 |

| Historical data | 2021 - 2026 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million, volume in tons, and CAGR from 2026 to 2035 |

| Report coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Application, By Technology / Processing Type, By Distribution Channel, By Regions |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

| Key companies profiled | Mitsui Chemicals, Inc.; SABIC; Solvay S.A.; DuPont de Nemours, Inc.; Evonik Industries AG; Saint-Gobain Performance Plastics Corporation; Ensinger GmbH; Victrex plc; Toray Industries, Inc |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments for Thermoplastic Polyimides:

- DuPont: The company invested $250 million in expanding its Circleville, Ohio, manufacturing site to increase production of Kapton® polyimide film and Pyralux® flexible circuit materials to meet growing global demand across various industries, including automotive and electronics.

- Arkema (via PI Advanced Materials): In June 2023, Arkema acquired a 54% stake in South Korean polyimide specialist PI Advanced Materials for approximately $1 billion, aiming to enhance its portfolio of high-performance materials for advanced electronics and electric mobility markets.

- VALIANT Co. Ltd.: This company is planning a significant capacity expansion to 1,500 tons annually by mid-2025 for its PTP-01 TPI product through its subsidiary, China Energy Conservation Wanrun (Penglai) New Materials Co., Ltd., to cater to growing demand in electronics and engineering applications.

- Asahi Kasei: The company announced plans in August 2025 to double production capacity of its PIMEL photosensitive polyimide by 2030 with an investment of about $102 billion, aiming to strengthen its supply position for semiconductor interlayer insulation.

- Evonik Industries: Evonik developed a new generation of polyimide fibers called P84 HT, which offers improved mechanical stability and flexibility under high temperatures for use in demanding applications.

What Are the Major Trends in the Thermoplastic Polyimides Market?

- Growing adoption of thermoplastic polyimides in flexible electronics, advanced semiconductor packaging, and 5G infrastructure is shaping market demand.

- Increasing use of thermoplastic polyimides in automotive, especially electric vehicle components requiring high temperature resistance and mechanical performance, is a key trend.

- Expansion of aerospace applications due to demand for lightweight, durable materials with high thermal stability is influencing market growth.

- Development of sustainable and recyclable thermoplastic polyimide resins, including bio-based options, is gaining traction in response to environmental focus.

- Advances in processing technologies, including injection molding, extrusion, and additive manufacturing, are broadening application opportunities for thermoplastic polyimides.

How Does AI Influence the Growth of the Thermoplastic Polyimides Industry in 2025?

In 2025, artificial intelligence supports the growth of the thermoplastic polyimides industry by accelerating material innovation and improving manufacturing efficiency, as AI-driven modelling helps optimize polymer properties while intelligent process control enhances production quality, consistency, and resource, enabling faster adoption of advanced high-performance materials across demanding applications.

Market Opportunity

Can Sustainable Materials Create New Demand for Thermoplastic Polyimides?

Thermoplastic polyimides present strong market opportunities as industries increasingly prioritize sustainable, lightweight, and high-performance materials for cleaner manufacturing and energy-efficient applications. Their durability and thermal stability make them suitable for products designed to reduce environmental impact while maintaining long service life.

Will Smart Manufacturing Improve Adoption of Thermoplastic Polyimides?

The growing use of digital tools such as artificial intelligence and smart factory systems is creating opportunities for thermoplastic polyimides by improving production efficiency, material consistent, and customization capabilities. These technologies support faster innovation and better alignment with evolving industrial requirements.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6067

Thermoplastic Polyimides Market Segmentation Insights

Product Type Insights:

Why the Films/ Sheets Segment Dominated the Thermoplastic Polyimides Market?

The films/ sheets segment dominated the market because of its extensive use in electronics, flexible circuits, insulation materials, and high-temperature electrical components. These forms offer excellent dimensional stability, dielectric strength, and resistance to harsh operating environments, making them highly suitable for demanding applications. Their adaptability across multiple industries ensures consistent demand and widespread adoption.

The coatings segment is projected to expand rapidly as industries increasingly seek surface protection solutions that offer thermal resistance, chemical durability, and extended service life. Thermoplastic polyimide coatings are gaining traction in aerospace, electronics, and industrial equipment due to their ability to enhance component performance without adding significant weight. Ongoing innovation in coating technologies continues to broaden application potential.

Application Insights:

Which Application Segment Dominated the Thermoplastic Polyimides Market in 2025?

The electronics & electrical segment registered strong dominance in the market, driven by growing demand for materials capable of withstanding high temperatures, electrical stress, and miniaturized designs. These polymers play a vital role in flexible electronics, insulation films, and semiconductor components where reliability is critical. Continuous advancements in electronic devices further reinforce their extensive use in this segment.

The aerospace and defense segment is anticipated to experience rapid growth as manufacturers increasingly prioritize lightweight, durable, and heat-resistant materials for advanced aircraft and defense systems. Thermoplastic polyimides support performance optimization and fuel efficiency while meeting stringent safety requirements. Rising innovation in aerospace technologies strengthens the demand trajectory for this application segment.

Technology/ Processing Type Insights:

How Injection Molding Segment Lead the Thermoplastic Polyimides Market in 2025?

The injection molding segment led the market due to its efficiency in producing complex, high-precision components required in automotive, electronics, and industrial applications. This method supports consistent quality, material efficiency, and scalability, making it a preferred choice for thermoplastic polyimide processing. Its compatibility with high-performance polymers further sustains its widespread use.

The extrusion segment is expected to grow rapidly as demand rises for continuous profiles, films, and sheets used across electronics and industrial applications. Extrusion offers flexibility in design and supports high volume production of uniform materials with excellent thermal and mechanical properties. Advancements in extrusion technology continue to enhance its adoption.

Distribution Channel Insights:

Which Distribution Channel Leads the Thermoplastic Polyimides Market?

The direct sales segment led the market as manufacturers and large industrial buyers favour close collaboration to meet precise material specifications and performance requirements. Direct enhancement enables better customization, technical support, and long-term supply agreements, which are essential in the high-performance materials market.

The online/digital platforms segment is projected to expand rapidly as digital procurement, supplier transparency, and faster sourcing gain importance across industrial markets. These platforms improve accessibility for specialized materials and support streamlined purchasing processes, particularly for small and mid-scale buyers seeking advanced polymer solutions.

Regional Insights

What Makes North America the Dominating Region in the Thermoplastic Polyimides Market?

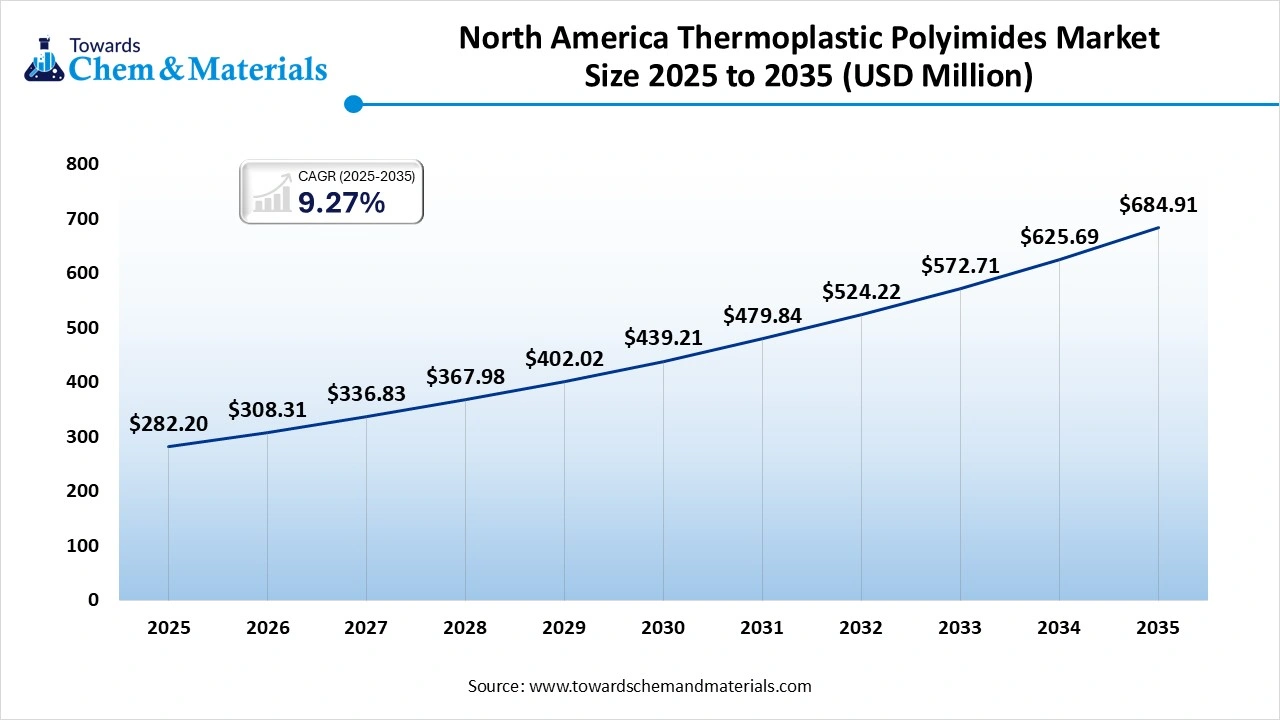

The North America thermoplastic polyimides market size was valued at USD 282.20 million in 2025 and is expected to reach USD 684.91 million by 2035, growing at a CAGR of 9.27% from 2026 to 2035. North America led the market with 35.48% share in 2025.

The market in North America holds a dominating position due to the strong presence of advanced manufacturing sectors such as aerospace, electronics, and automotive that require high-performance polymers with excellent heat resistance a mechanical property, and this regional strength is further supported by robust industrial investment and early adoption of specialty materials for next-generation components.

U.S. Thermoplastic Polyimides Market Trends

Within North America, the U.S. stands out as a major contributor to market demand because of its large aerospace manufacturing base, extensive defence applications, and well-established electronics and semiconductor industries that emphasize innovation and performance requirements suited to thermoplastic polyimides.

Why Is Asia Pacific the Growing Region in the Thermoplastic Polyimides Market?

Asia Pacific is emerging as the fastest growing region in the market because rapid industrial expansion in sectors such as electronics, automotive, and semiconductor fabrication is increasing demand for high performance polymers that can withstand demanding conditions, and cost-effective manufacturing infrastructure, combined with rising investment in advanced materials, is strengthening regional growth prospects. The region’s expansive production ecosystem and growing uptake of engineering polymers are major factors driving accelerated adoption of thermoplastic polyimides compared with other regions.

China Thermoplastic Polyimides Market Trends

China stands out within the Asia Pacific’s market growth due to its dominant position in electronics manufacturing, rapid expansion of electric vehicle production, and strong focus on technological self-reliance, all of which boost demand for high-temperature and high-performance polymers such as thermoplastic polyimides, reinforcing the country’s influence on regional market dynamics.

Top Companies in the Thermoplastic Polyimides Market & Their Offerings:

Tier 1:

- DuPont de Nemours, Inc.: Offers the Vespel line of polyimide parts and the Kapton family of versatile polyimide films for extreme thermal environments.

- Toray Industries, Inc.: Provides high-temperature polyimide prepregs (e.g., TC890) and has developed breakthrough photosensitive polyimides for next-gen electronics.

- Solvay Speciality Polymers: Markets high-performance thermoplastics with exceptional heat resistance and flame retardancy, including TPI-based solutions for aerospace and industrial use.

- Kaneka Corporation: A leader in high-performance polyimide films, focusing on R&D for advanced thermal, electrical, and mechanical properties.

- Mitsubishi Gas Chemical Company, Inc.: Offers specialty polyimides and super-engineering plastics, though specific 2025 TPI brand names are less publicized in general listings.

- Arkema S.A.: Provides high-performance specialty materials, including advanced thermoplastic solutions for demanding automotive and aerospace applications.

- BASF SE: Primarily focuses on high-performance polyamides (e.g., Ultramid) and polyarylethersulfones (Ultrason) rather than a dedicated TPI line.

- Ascend Performance Materials: A leading integrated producer of PA66 resins (Vydyne, Starflam), with no primary 2025 product focus in TPI.

- Zhejiang Jingxin Polymer Materials Co., Ltd.: Specializes in Chinese-market manufacturing of high-performance polymer compounds, including heat-resistant engineering plastics.

More Insights in Towards Chemical and Materials:

Thermoplastic Elastomers (TPEs) Market Volume to Exceed 11.84 Million Tons by 2034

Recycled thermoplastics Market Size to Exceed USD 145.34 Bn by 2034

Thermoplastics In Construction Films Market Size to Hit USD 23.05 Bn by 2034

Plastic Waste Pyrolysis Oil Market Size to Hit USD 1,365.54 Mn by 2035

Chemical Recycling of Plastics Market Size to Hit USD 47.60 Bn by 2035

Bioplastic Textiles Market Size to Hit USD 34.53 Billion by 2035

Bioplastic Compounding Market Volume to Hit 12.54 Million Tons 2035

Bioplastics in Diagnostic Devices Market Size to Hit USD 879.46 Million by 2035

Bioplastics In Medical Devices Market Size to Surpass USD 6.73 Billion by 2035

Asia Pacific Plastic Resin Market Size to Surpass USD 704.98 Bn by 2035

Plastic Resin Market Size to Surpass USD 1,384.76 Billion by 2035

Thermoplastic Polyimides Market Size to Hit USD 1,926.61 Mn by 2035

Europe Biodegradable Plastics Market Size to Reach USD 39.50 Bn by 2035

U.S. Bioplastics Market Size to Reach USD 21.84 Bn by 2035

Aerospace Plastics Market Size to Worth Around USD 23.28 Bn by 2035

Europe Bioplastics and Biopolymers Market Size to Reach USD 34.37 Bn by 2035

U.S. Bioplastics and Biopolymers Market Size to Surpass USD 34.37 Bn by 2035

Plastic Processing Machinery Market Size to Hit USD 41.40 Bn by 2035

Europe Recycled Plastics Market Size to Surpass USD 33.84 Bn by 2035

Asia Pacific Recycled Plastics Market Size to Surpass USD 72.11 Bn by 2034

Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

Plastic Waste Management Market Size to Reach USD 54.66 Bn by 2034

Mechanical Recycling of Plastics Market Size to Surge USD 92.86 Bn by 2034

Recycled Plastic Pipes Market Size to Hit USD 20.08 Billion by 2034

Carbon Fiber Reinforced Plastic (CFRP) Market Size to Surge USD 48.08 Bn by 2034

Plastic Hot and Cold Pipe Market Size to Hit USD 14.93 Bn by 2034

Commodity Plastics Market Size to Hit USD 666.76 Billion by 2034

U.S. Biodegradable Plastics Market Size to Hit USD 5.27 Billion by 2034

Thermoplastic Polyimides Market Top Key Companies:

- Mitsui Chemicals, Inc.

- SABIC

- Solvay S.A.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Saint-Gobain Performance Plastics Corporation

- Ensinger GmbH

- Victrex plc

- Toray Industries, Inc.

Recent Developments

- In July 2025, Arkema (via its affiliate PI Advanced Materials) launched Zenimid, a new ultra-high-performance thermoplastic polyimide brand, positioning it for demanding markets such as aerospace, EV battery systems, 5G infrastructure, and FPCBs.

- In August 2025, Asahi Kasei announced plans to double production capacity of its PIMEL photosensitive polyimide (PSPI) by 2030, investing about USD 102 billion to strengthen its supply position for semiconductor interlayer insulation.

- In July 2025, Toray Industries announced the development of STF-2000, a breakthrough photosensitive polyimide that enables exceptional microfabrication precision and sustainability by eliminating harmful chemicals. This material supports advanced electronics and MEMS applications, reinforcing demand for next-generation thermoplastic polyimide solutions with fine patterning capabilities.

Thermoplastic Polyimides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Thermoplastic Polyimides Market

By Product Type

- Film / Sheets

- Rods / Tubes

- Coatings

- Fibres / Filaments

- Others

By Application

- Electronics & Electrical

- Automotive

- Aerospace & Defense

- Industrial Machinery

- Medical Devices

- Others

By Technology / Processing Type

- Injection Molding

- Extrusion

- Coating / Lamination

- Others

By Distribution Channel

- Direct Sales

- Distributors & Resellers

- Online / Digital Platforms

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6067

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/